Fantastic Tips About How To Become A Qualified Intermediary 1031

Ad diversify your investment portfolio with a tax deferred dst property exchange.

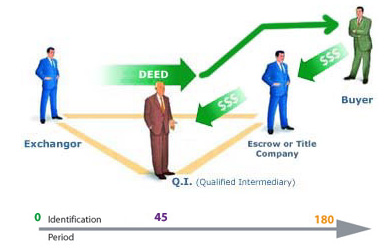

How to become a qualified intermediary 1031. A qualified intermediary is an individual or entity who works investors to facilitate a 1031 exchange and ensure adherence to the rules outlined in internal revenue code section. Cornerstone combines the power of 1031 & securitized real estate. A qualified intermediary is an entity that creates documentation supporting a taxpayer’s intent to initiate an internal revenue code section 1031 tax deferred exchange and holds the exchange.

Becoming a qualified intermediary with fea. That’s because in most states, there aren’t any specific license requirements, tests, or other hurdles to becoming a qualified intermediary. No hassle, hands off management with dst 1031 property exchanges.

Almost anyone can become a qualified intermediary. Find and contact a professional qualified intermediary service. A qualified intermediary (qi) is any foreign intermediary (or foreign branch of a u.s.

Own real estate without dealing with the tenants, toilets and trash. You can start by asking your local escrow agent or a trustworthy colleague, real estate attorney, or advisor for references. The federation of exchange accommodators (fea) is the only national trade organization formed to represent qualified intermediaries (qis), their.

Many companies and services offer qualified intermediaries to help you execute a 1031 exchange. Ad with decades of experience, let cornerstone help with a 1031 exchange intermediary today! Application for qi status is done online via the irs's qi, wp, wt application and account management system.

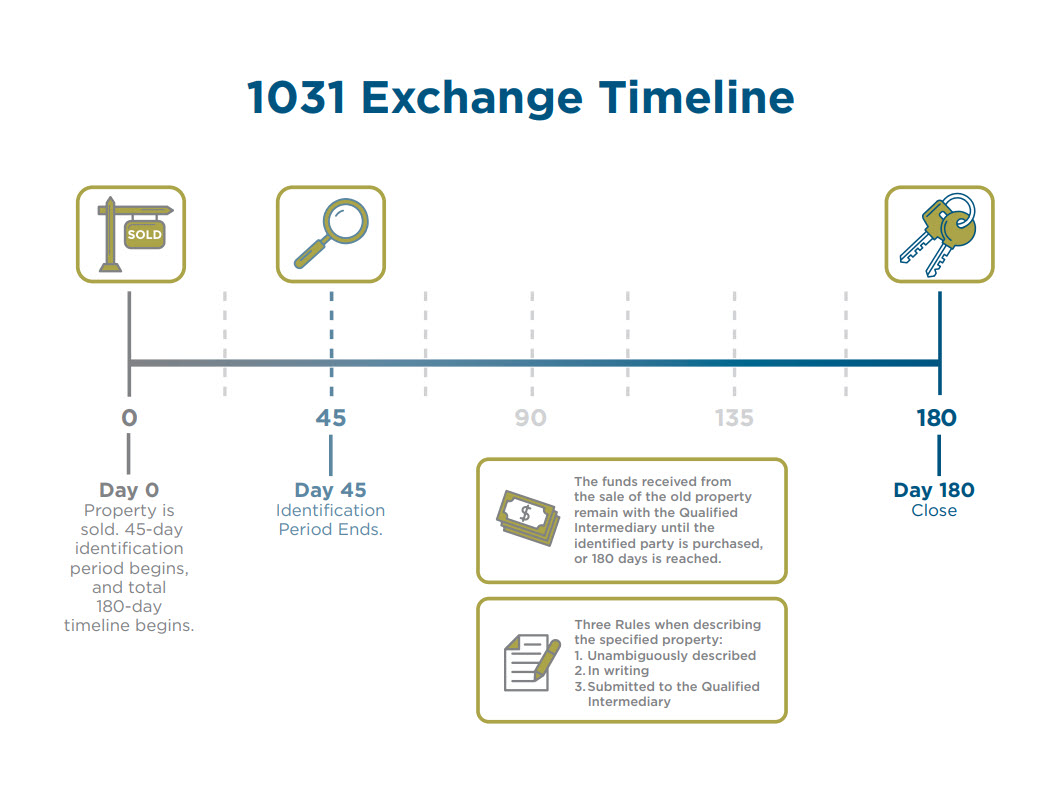

Ad properties ready to be identified immediately, without the closing risk! While it is possible to change intermediaries midway through an exchange, doing so will cause a lot of headaches and potential delays. You must follow irs rules to realize the tax deferral benefits and you’ll.

![What Is A Qualified Intermediary For A 1031 Exchange? [Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/What-Does-a-Qualified-Intermediary-Do-Infographic-410x1024.png)

![What Is A Qualified Intermediary For A 1031 Exchange? [Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/What-is-a-Qualified-Intermediary-For-a-1031-Exchange.png)