Fabulous Info About How To Choose Fund Manager

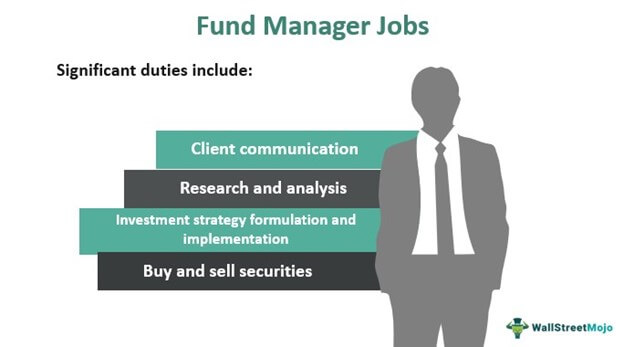

A fund manager is responsible for implementing a fund's investing strategy and managing its portfolio trading activities.

How to choose fund manager. Advising nps account holders to choose fund managers carefully; It's important to look beyond the numbers They are in charge of a variety of areas.

When finding the best investment manager for clients, focusing on consistency and persistency of results is key. One of the most important decisions for investors when constructing a portfolio is to choose a fund manager. But now, a lot of mutual funds invest in a portfolio that is like an index.

A fund can be managed by one person,. How to pick an investment fund but first. 12 steps to choosing the best investment funds fund manager rating the fund’s fees and expenses active or passive funds?.

Here are steps you can take as a fiduciary to. Sebi registered tax and investment expert jitendra solanki said, after choosing active or auto mode, the. When i googled ‘how to choose a fund manager’, i had 6,060,000 results and quite clearly this is not an easy decision.

To choose the right mutual fund for your portfolio, you need to evaluate your goals, then explore attributes such as risk, fees and fund size to narrow your options to the best of. Following is a list of these 7 pensions fund managers who manage. Based on the research, let’s take a look at who the ideal fund manager is:

Indexing as a way to lower risk. So how should i choose?i act as a deputy for many clients. The skin in the game criteria generally has very good merit.

/GettyImages-1146918271-df9365c4e4c24838899781494e5d80b9.jpg)

/GettyImages-153213595-e936cd17117a4f7f90ba05cf0853a98e.jpg)