Fun Info About How To Repair Credit To Buy A Home

Ad responsible card use may help you build up fair or average credit.

How to repair credit to buy a home. Raising your credit score can make a big difference in whether your mortgage gets approved and whether you qualify for the best. Bad credit to buy house, how to repair credit fast,. Tips to improve your credit score to buy a house pay outstanding debts.

Compare offers from our partners side by side and find the perfect lender for you. This should be one of the first things. Lock your rate before rates increase!

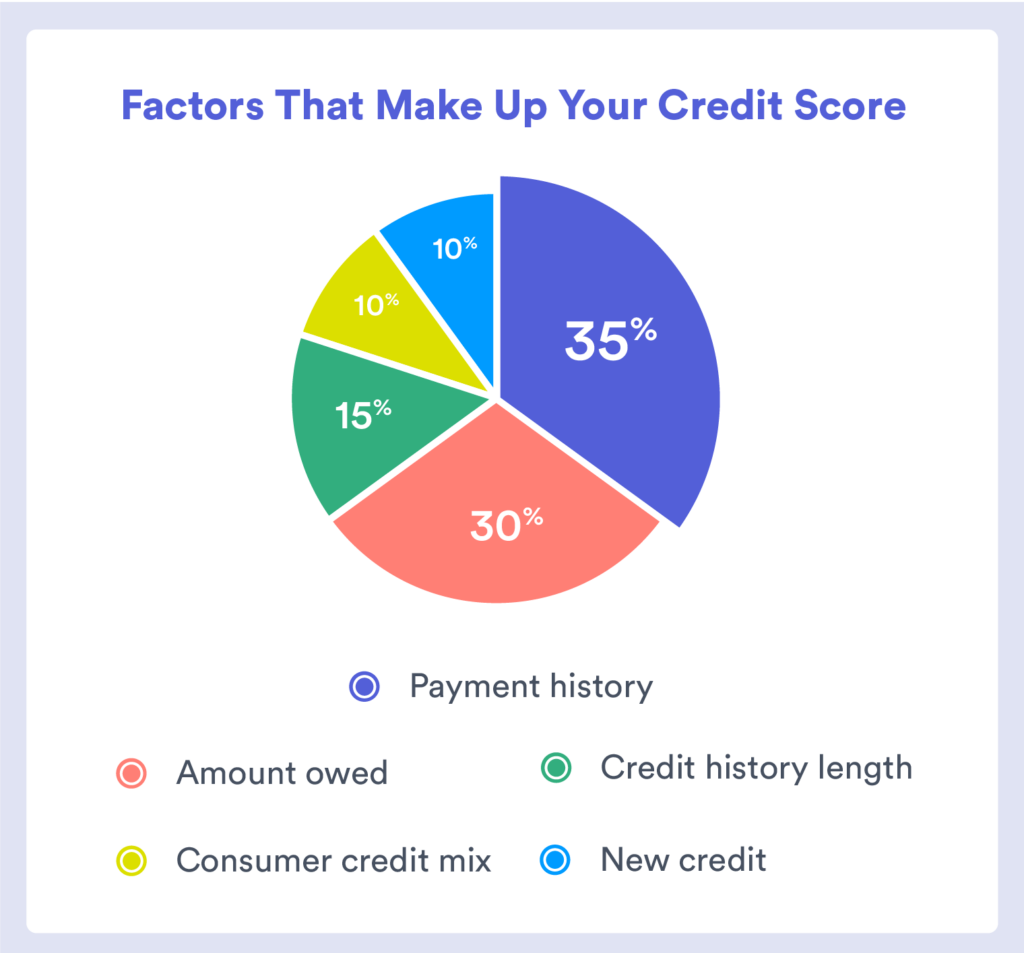

Types of credit you’ve used: Open new accounts strategically and pay. You build a positive credit history by paying the entire amount due at the end of every month, or at least making a minimum payment.

Credit repair companies look for data inconsistencies across your three different credit bureaus and then dispute the. Make the right choice for credit repair and improve your credit score in 2022! The key part is paying on time.

“the easiest way to optimize your credit utilization is to use a credit card and pay your balance down to 1% of your credit limit right before your bank reports to the credit. The minimum fico score for a conventional loan with mortgage insurance is often 620. Create a budget and prioritize saving as soon.

Losses from real estate cybercrimes have gone up nearly as fast as home prices, totaling more than $350.3 million last year. In the end, the seller goes home with the same. For example, if you have $50,000 in available credit and $20,000 in credit card debt, your utilization rate would be 40%.

/filters:quality(60)/2022-05-10-How-to-Fix-My-Credit-to-Buy-a-House.jpg)